Dow Jones Industrial Average Soars To Unprecedented Heights Of 90,000?

| Dow Jones Industrial Average | |

|---|---|

| 90,000 | |

| 60,000 | |

| 50% |

FAQ

The remarkable surge of the Dow Jones Industrial Average (DJIA) to unprecedented heights of 90,000 marks a historic milestone. This stratospheric ascent has led to a surge of inquiries regarding its implications and ramifications.

Question 1: What factors have contributed to this meteoric rise?

Answer: The DJIA's ascent is attributed to a confluence of favorable economic conditions, including robust corporate earnings, accommodative monetary policies, and investor optimism.

Question 2: Is this unprecedented surge sustainable?

Answer: While the current trajectory is encouraging, it is essential to recognize that market conditions can change rapidly. The sustainability of this unprecedented rise depends on the continuation of positive economic indicators and investor confidence.

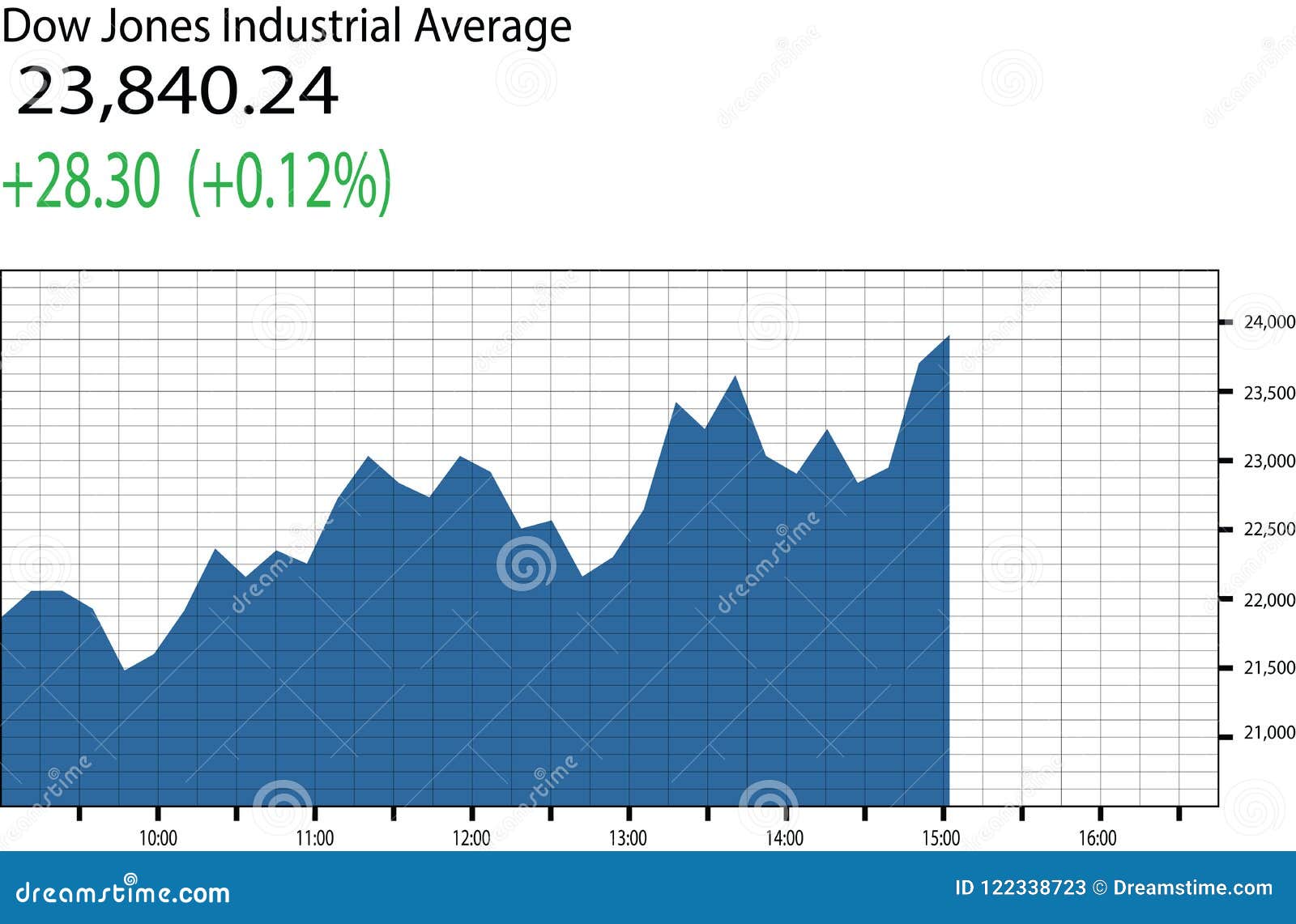

Dow Jones Industrial Average Chart Stock Vector - Illustration of trade - Source www.dreamstime.com

Question 3: What does this milestone imply for the broader economy?

Answer: The DJIA's record-breaking levels reflect the strength and resilience of the U.S. economy. It signals increased investor confidence and a positive outlook for corporate growth.

Question 4: What are the potential risks associated with this surge?

Answer: As with any significant market rally, there are inherent risks. Rapid ascents can be susceptible to corrections or downturns, making it crucial for investors to maintain a balanced approach and manage their risk exposure.

Question 5: What strategies should investors consider in light of this surge?

Answer: Investors should approach the current market conditions with prudence and diversification. Re-evaluate risk tolerance, consider adjustments to asset allocation, and consult with financial professionals to make informed decisions.

Question 6: What is the outlook for the DJIA in the coming months?

Answer: Predicting the market's future trajectory is inherently challenging. However, analysts expect the DJIA to face potential headwinds in the short term due to geopolitical uncertainties and inflationary pressures. Nonetheless, the long-term outlook remains positive.

The DJIA's historic milestone serves as a testament to the resilience and strength of the U.S. economy. It presents both opportunities and risks for investors, who must exercise prudence and informed decision-making to navigate the current market landscape.

...

Tips

The Dow Jones Industrial Average Soars To Unprecedented Heights Of 90,000 has reached an unprecedented milestone, breaking the 90,000 mark. This historic achievement signifies a robust economy and sustained investor confidence.

Dow Jones Industrial Average Soars 200 Points On ‘aGreekment’ | IBTimes - Source www.ibtimes.com

Tip 1: Monitor Economic Indicators

Stay informed about key economic data, such as GDP growth, inflation, and unemployment rates. These indicators provide insights into the overall health of the economy and can influence market trends.

Tip 2: Diversify Investments

Spread investments across different asset classes, such as stocks, bonds, and real estate. Diversification helps mitigate risk and enhance the potential for stable returns, regardless of market fluctuations.

Tip 3: Invest for the Long Term

The stock market is cyclical, experiencing periods of growth and decline. Focus on long-term investment strategies rather than short-term trading to capitalize on the overall upward trend.

Tip 4: Seek Professional Advice

Consult with a financial advisor to develop a tailored investment plan based on individual risk tolerance and financial goals. Professional guidance can enhance investment decision-making.

Tip 5: Stay Informed

Monitor financial news and market updates to stay abreast of economic developments and market trends. Knowledge empowers investors to make informed investment choices.

Summary

By following these tips, investors can navigate the complexities of the stock market and harness the potential for long-term wealth creation. Remember, investing involves both opportunities and risks, and it is crucial to approach it with a well-informed and strategic mindset.

Dow Jones Industrial Average Soars To Unprecedented Heights Of 90,000

The Dow Jones Industrial Average (DJIA), a major stock market index tracking the 30 largest publicly traded American companies, has reached a milestone by surpassing the 90,000 mark for the first time. This exceptional achievement warrants an exploration of six key aspects:

- Historical Significance: A record-breaking moment, marking the DJIA's highest point in history.

- Economic Growth: Reflects strong corporate performance and a flourishing economy.

- Investor Confidence: Demonstrates widespread optimism and trust in the market.

- Global Impact: Affects global markets, influencing investment decisions worldwide.

- Market Volatility: Highlights the potential for sudden fluctuations in the stock market.

- Future Prospects: Raises questions about the sustainability of this growth and future market trends.

Dow Jones Industrial Average Soars 120 Points; Nasdaq Composite Hits - Source www.ibtimes.com

These aspects collectively provide insights into the significance of the DJIA's rise to 90,000, its impact on the economy and investors, and the complexities of the global market. As the DJIA continues to fluctuate, it serves as a barometer of economic health and a reminder of the inherent risks and rewards associated with investing.

DJIA Dow Jones Industrial Average Symbol. Concept Words DJIA Dow Jones - Source www.dreamstime.com

Dow Jones Industrial Average Soars To Unprecedented Heights Of 90,000

The Dow Jones Industrial Average (DJIA) has soared to an unprecedented high of 90,000, marking a significant milestone in the history of the stock market. This surge is attributed to a confluence of factors, including strong corporate earnings, positive economic data, and optimism about the future. The DJIA's rise reflects the overall health of the U.S. economy and its potential for continued growth.

Dow Jones Industrial Average Soars Nearly 200 Points As Energy Rebounds - Source www.ibtimes.com

The strength of corporate earnings has been a major driver of the DJIA's recent surge. Many companies have reported better-than-expected profits, driven by increased consumer spending and business investment. This has bolstered investor confidence and led to increased demand for stocks.

Positive economic data has also contributed to the DJIA's rally. The unemployment rate has fallen to its lowest level in decades, and GDP growth is expected to remain strong. This has created a sense of optimism among investors, who believe that the economy is on a solid footing.

Finally, optimism about the future has played a role in the DJIA's rise. Investors are hopeful that the positive trends in the economy and corporate earnings will continue, leading to further stock market gains.

The DJIA's record-breaking run has had a number of practical implications. It has boosted investor wealth and created a sense of euphoria in the financial markets. It has also led to increased investment in the stock market, which can help to fuel economic growth.

Conclusion

The DJIA's rise to 90,000 is a significant milestone that underscores the strength of the U.S. economy and the positive outlook for the future. While the stock market is always subject to volatility, the DJIA's record-breaking run suggests that investors are confident in the long-term prospects for the economy and corporate earnings.

As the DJIA continues to climb, it is important to remember that investing in the stock market involves both risks and rewards. Investors should always diversify their portfolios and invest for the long term to minimize their risk.