Tesla stock has been one of the most popular and volatile stocks on the market in recent years. Investors have been eager to get their hands on shares of the electric car maker, and the stock price has reflected that demand. But what exactly is Tesla stock price, and what factors affect it?

To help you make sense of Tesla stock price, we've put together this guide. We'll cover everything you need to know about Tesla stock, including:

| Key Differences | Key Takeaways |

|---|---|

| Company | Tesla, Inc. |

| Ticker Symbol | TSLA |

| Exchange | NASDAQ |

| Sector | Automotive |

| Industry | Electric Vehicles |

| Founded | 2003 |

| Headquarters | Palo Alto, California |

| CEO | Elon Musk |

FAQ

Welcome to our comprehensive resource on Tesla's stock price, where we present real-time quotes, historical data, and in-depth analysis. Please find below a compilation of Frequently Asked Questions for your reference.

Tesla Stock Price Target 2024 - Alfy Louisa - Source druysibelle.pages.dev

Question 1: What factors influence Tesla's stock price?

Tesla's stock price is primarily driven by the company's financial performance, including its revenue, earnings, and sales volume. Macroeconomic factors such as interest rates, inflation, and geopolitical events can also impact the stock's valuation.

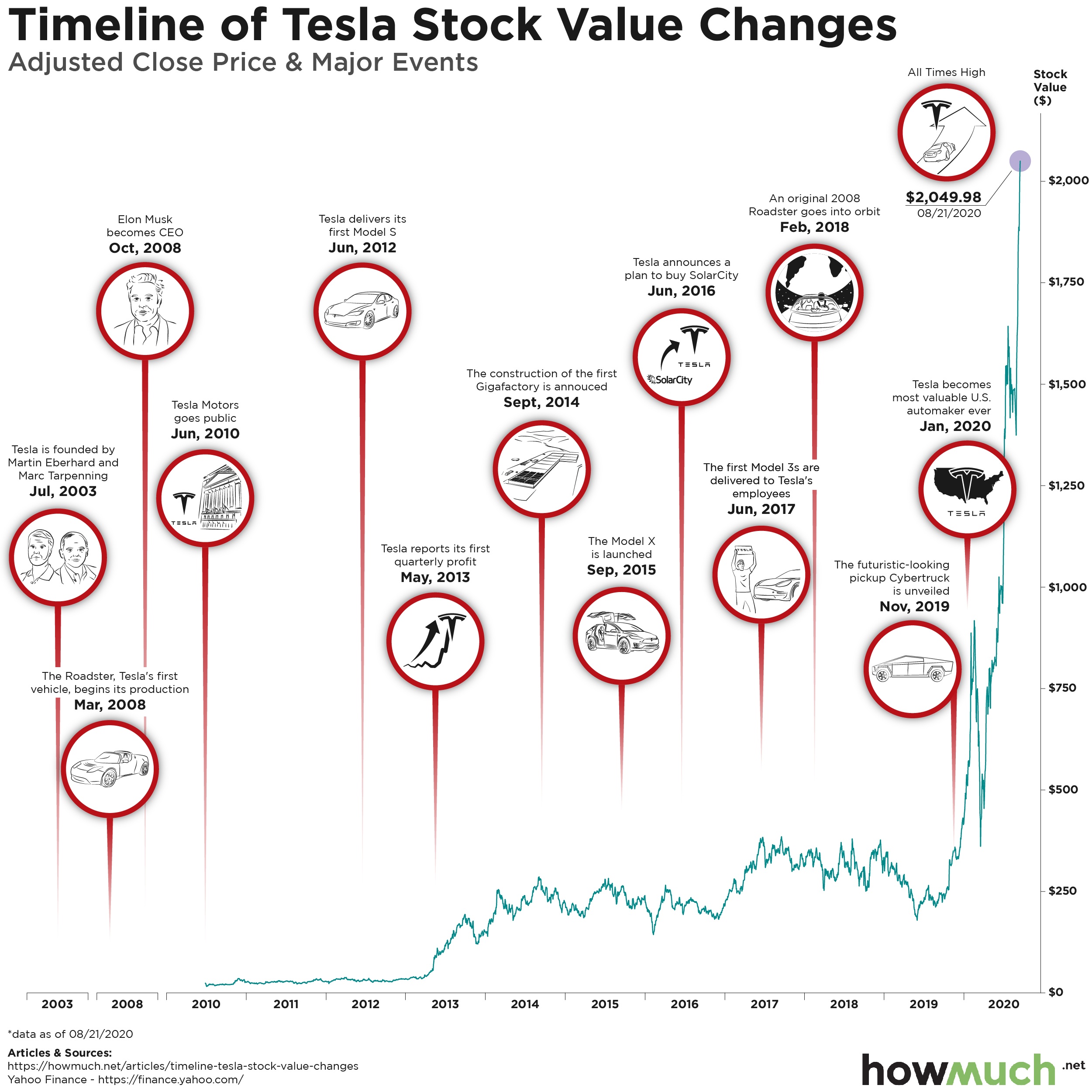

Question 2: What are the historical trends of Tesla's stock price?

Tesla's stock price has experienced significant fluctuations since its initial public offering in 2010. Following a rapid ascent in recent years, the stock has shown a stabilizing trend in 2023, with moderate growth and occasional price corrections.

Question 3: What is the company's outlook and potential for future growth?

Tesla's future outlook remains bullish, as it is well-positioned in the rapidly expanding electric vehicle market. The company's ongoing efforts in innovation, new product launches, and expansion into new markets are expected to drive continued growth in the coming years.

Question 4: What are some risks to consider when investing in Tesla stock?

Like any investment, Tesla stock carries certain risks. These include technological disruptions, market competition, regulatory changes, and macroeconomic fluctuations. It is important to conduct thorough research and consider both the risks and potential rewards before making an investment decision.

Question 5: Where can I find up-to-date information on Tesla's stock performance?

This website provides comprehensive and up-to-the-minute information on Tesla's stock price, including real-time quotes, historical charts, and expert analysis. We encourage you to explore our platform for the most accurate and reliable data.

Question 6: What resources are available for further research on Tesla's stock?

Various reputable sources offer in-depth research and analysis on Tesla's stock. We recommend consulting industry experts, financial publications, and SEC filings to gain a comprehensive understanding of the company's performance and future prospects.

Summary of key takeaways or final thought

Please note that the information provided here is for informational purposes only and should not be construed as financial advice. Investing in stocks involves risk, and it is essential to consult with a qualified financial advisor before making any investment decisions.

Transition to the next article section

Tips for Understanding Tesla Stock Price

For savvy investors and financial analysts, understanding Tesla's stock price is crucial. Here are some valuable tips to consider:

Tip 1: Track Key Metrics:

Monitor Tesla's financial performance by tracking revenue, earnings, cash flow, and other relevant metrics. Tesla Stock Price: Real-Time Quotes, Historical Data, And Analysis can provide historical data to identify trends and potential growth areas.

Tip 2: Stay Informed:

Follow Tesla's news, announcements, and industry updates to gain insights into factors influencing its stock price. Read SEC filings, press releases, and attend investor presentations.

Tip 3: Understand Market Sentiments:

Market sentiment plays a significant role in stock prices. Pay attention to analyst ratings, news coverage, and social media discussions to gauge market sentiment towards Tesla.

Tip 4: Set Realistic Expectations:

Avoid getting caught up in hype or FOMO. Set realistic price targets based on Tesla's fundamentals and market dynamics. Consider both potential risks and opportunities.

Tip 5: Use Technical Analysis:

Technical analysis can provide valuable insights into stock price patterns and potential support and resistance levels. Study charts and indicators to identify potential trading opportunities.

Tip 6: Consider Long-Term Trends:

Don't limit your analysis to short-term fluctuations. Understand Tesla's long-term growth trajectory and assess potential impacts of emerging technologies, regulatory changes, and industry competition.

Tip 7: Seek Professional Advice:

Consider consulting with a financial advisor or investment professional to get personalized guidance and make informed investment decisions based on your financial goals and risk tolerance.

These tips can help investors make more informed decisions regarding Tesla's stock price. By staying updated, understanding market dynamics, and setting realistic expectations, you can navigate the investing landscape with confidence.

Tesla Stock Price: Real-Time Quotes, Historical Data, And Analysis

Understanding the Tesla stock price is crucial for investors, analysts, and industry enthusiasts. This comprehensive guide explores six essential aspects of Tesla's stock performance, providing insights through real-time quotes, historical data, and expert analysis.

- Real-Time Monitoring: Keep track of the latest stock movements.

- Historical Analysis: Examine price trends and patterns over time.

- Earnings Reports: Analyze financial performance and impact on stock price.

- Industry News: Stay abreast of developments that influence Tesla's valuation.

- Technical Analysis: Identify potential entry and exit points using charts and indicators.

- Expert Commentary: Access insights and opinions from industry experts.

These key aspects provide a comprehensive view of Tesla's stock performance. Real-time monitoring allows for informed decision-making, while historical analysis helps identify long-term trends. Earnings reports offer insights into the company's financial health, and industry news keeps investors updated on market dynamics. Technical analysis provides actionable insights, and expert commentary brings valuable perspectives from experienced professionals. By considering these aspects together, investors can gain a deeper understanding of Tesla's stock price and make informed investment decisions.

Tesla Stock Price To High IMO Classic Throw Pillows sold by Daniil - Source printerval.com

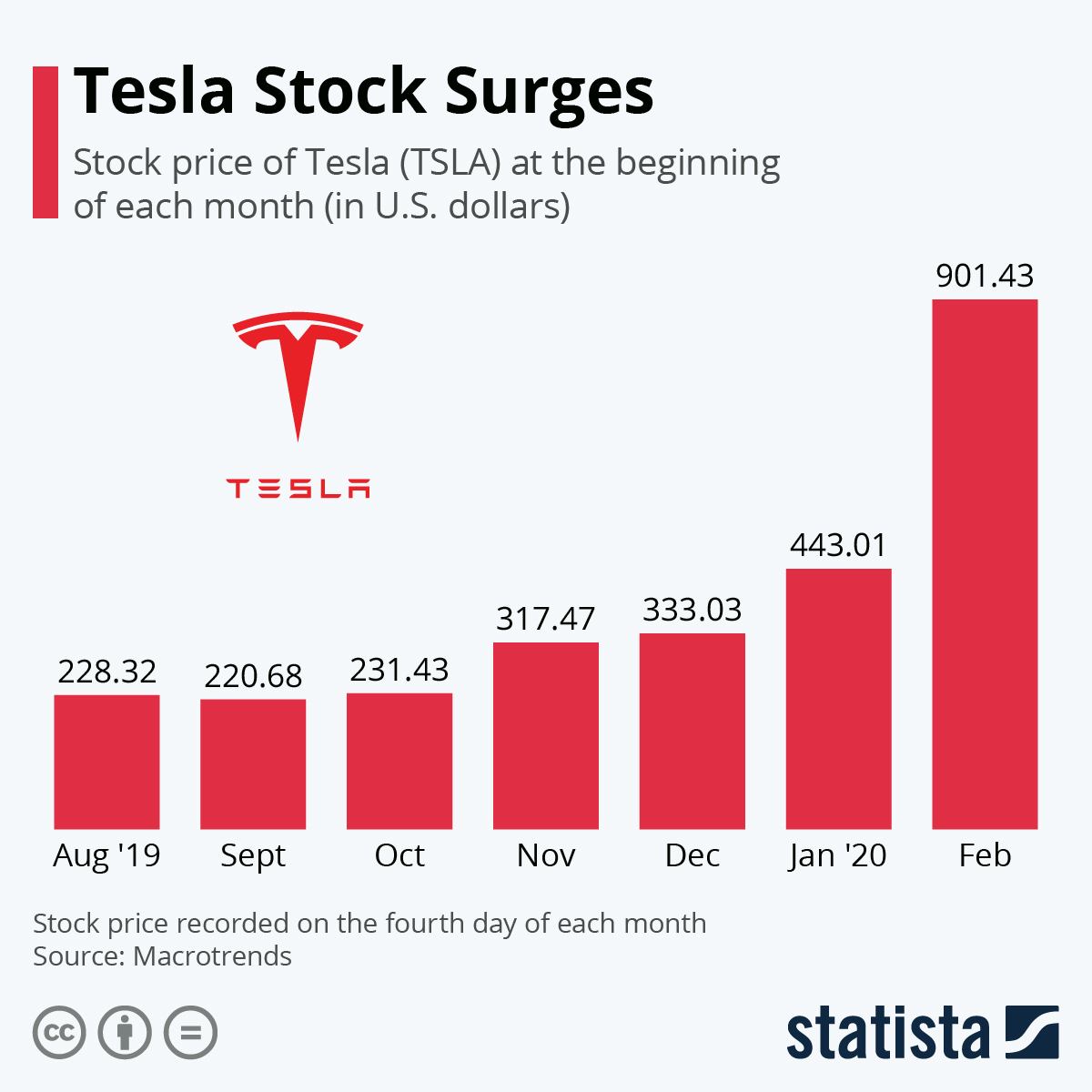

Chart: Tesla Stock Surges | Statista - Source www.statista.com

Tesla Stock Price: Real-Time Quotes, Historical Data, And Analysis

To understand the connection between "Tesla Stock Price: Real-Time Quotes, Historical Data, And Analysis", it's important to grasp the significance of each component and how they collectively contribute to a comprehensive understanding of Tesla's stock performance.

Tesla stock - Shonna Parra - Source heidygossett.blogspot.com

Real-time quotes provide an up-to-date snapshot of Tesla's stock price, reflecting the current market sentiment and the latest news or events. These quotes allow investors to make informed trading decisions by gauging the stock's immediate value and identifying potential market opportunities.

Historical data, on the other hand, offers a retrospective view of Tesla's stock performance over a specific period, typically spanning multiple years. By analyzing historical trends, investors can identify patterns, assess the stock's volatility, and make projections about its future trajectory. These insights help investors make informed long-term investment strategies.

Combining real-time quotes and historical data provides a holistic view of Tesla's stock price, allowing investors to make well-rounded decisions. Real-time quotes capture the immediate market dynamics, while historical data offers context and a basis for trend analysis. Together, they provide a comprehensive understanding of Tesla's stock performance, empowering investors to navigate market fluctuations and maximize their returns.