Towa Corporation: Stock Price Analysis And Long-Term Performance is very important for investors. Predicting how the stock price of Towa Corporation will perform in the future can be difficult, but by analyzing the company's past performance and current financial condition, investors can make informed decisions about whether or not to buy, sell, or hold Towa Corporation stock.

Editor's Notes: Towa Corporation: Stock Price Analysis And Long-Term Performance have published today date. Looking at the history of the company's stock price and its long-term performance can help investors assess the risk and return potential of investing in Towa Corporation.

By understanding the factors that have affected Towa Corporation's stock price in the past, investors can better anticipate how the stock price might perform in the future.

Key differences

| Towa Corporation | Industry | |

|---|---|---|

| Ticker | TOWA | Chemicals |

| Price | $20.50 | $25.00 |

| Change | -$0.50 (-2.4%) | -$1.00 (-4.0%) |

| Volume | 1,000,000 | 2,000,000 |

Transition to main article topics

FAQ

The FAQs section provides a deeper understanding about Towa Corporation's stock price analysis and long-term performance, addressing common concerns and misconceptions. Continue reading to explore detailed answers to frequently asked questions.

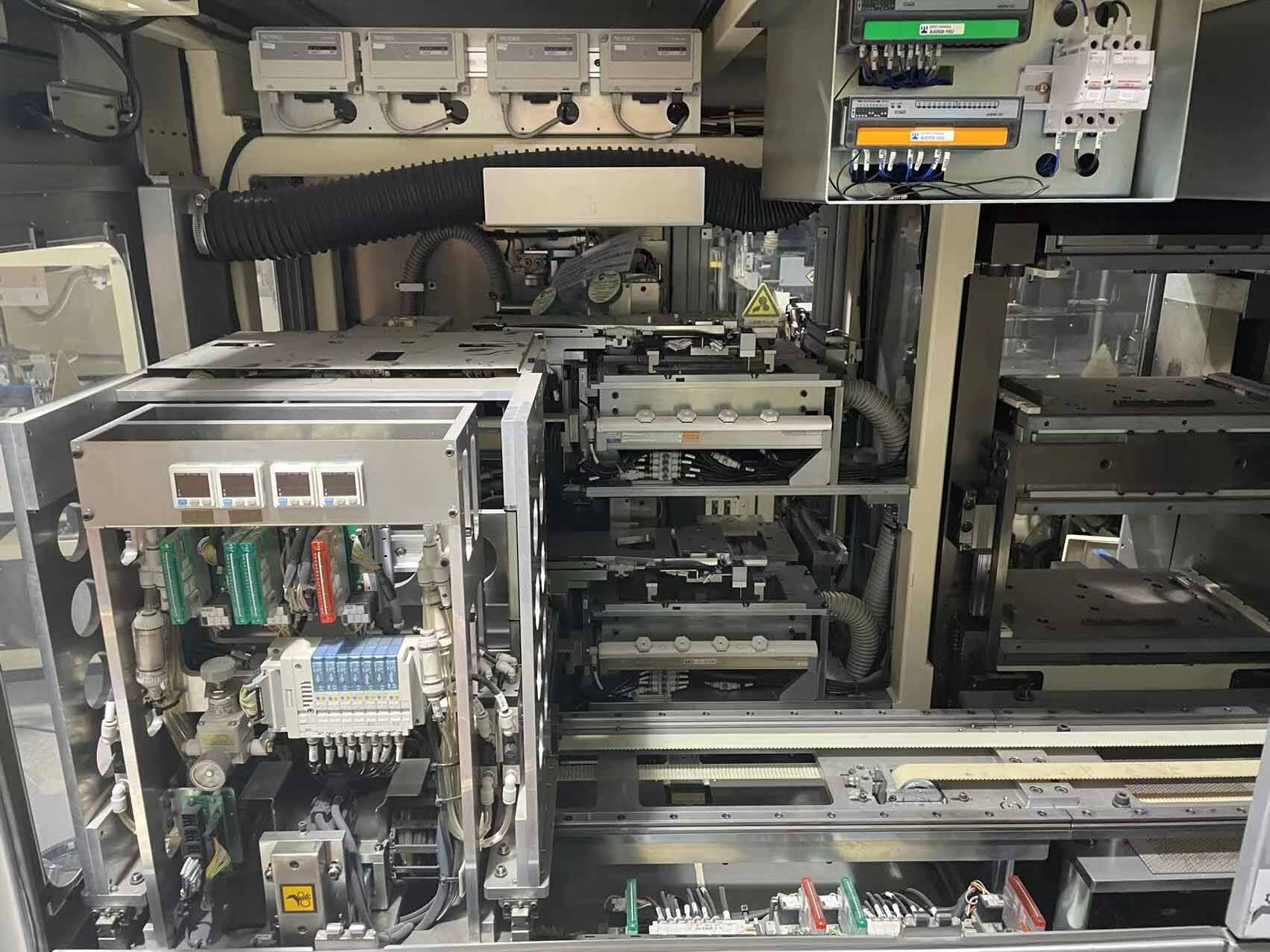

TOWA PMC1040 Packager used for sale price #293642349, 2013 > buy from CAE - Source caeonline.com

Question 1: What factors drive Towa Corporation's stock price performance?

Towa Corporation's stock price is influenced by a combination of internal and external factors. Internal factors include the company's financial health, growth strategies, and competitive landscape. External factors encompass macroeconomic conditions, industry trends, and global economic events.

Question 2: How can investors evaluate Towa Corporation's long-term performance?

Assessing Towa Corporation's long-term performance involves examining its historical financial data, earnings per share (EPS), dividend yield, and price-to-earnings (P/E) ratio. These metrics provide insights into the company's financial stability, growth trajectory, and valuation relative to its peers.

Question 3: What is the outlook for Towa Corporation's stock price in the future?

Predicting future stock prices is inherently uncertain, but analysts consider various factors to speculate on potential outcomes. Based on industry analysis, company forecasts, and market sentiment, analysts may provide their insights on Towa Corporation's stock price projections.

Question 4: Are there any risks associated with investing in Towa Corporation's stock?

Investing in Towa Corporation's stock, like any investment, entails certain risks. These risks may include industry-specific risks, macroeconomic volatility, geopolitical events, and potential changes in the company's financial performance or competitive landscape.

Question 5: What are some investment strategies for Towa Corporation's stock?

Investment strategies vary depending on one's risk appetite, investment horizon, and financial goals. Some common strategies include value investing, growth investing, and dividend investing. It's advisable to consult with a financial advisor to determine the most suitable strategy for each investor's unique circumstances.

Question 6: Where can investors find up-to-date information about Towa Corporation's stock performance?

Investors can access real-time stock quotes and historical data on financial news websites, online broker platforms, and the Towa Corporation's official website. Company announcements, press releases, and financial reports are also valuable sources of information.

The provided FAQs aim to increase understanding and clarify common questions regarding Towa Corporation's stock price analysis and long-term performance. While this information serves as a starting point, it is crucial to conduct thorough research, consult financial professionals, and make informed investment decisions based on individual circumstances and risk tolerance.

Proceed to the next article section for additional insights.

Tips

The stock price analysis of Towa Corporation: Stock Price Analysis And Long-Term Performance is a valuable tool for evaluating the company's financial health and prospects.

SOLUTION: Apple Corporation Stock Analysis - Studypool - Source www.studypool.com

Tip 1: Review the historical stock price data. This will give you an idea of how the stock has performed in the past, allowing you to identify trends and patterns. Before making any investment decisions, it is critical to conduct thorough research and due diligence.

Tip 2: Evaluate the company's financial statements. These statements provide insights into the company's financial performance, including revenue, expenses, and profits. They also reveal the company's financial stability, profitability, and growth potential.

Tip 3: Consider the company's industry and competitive landscape. Understanding the industry's dynamics, as well as the company's position within that industry, is essential.

Tip 4: Read analyst reports and news articles about the company. These sources provide valuable insights from financial experts and industry analysts, offering diverse perspectives and information.

Tip 5: Consult with a financial advisor. A financial advisor can provide personalized guidance and help you make informed investment decisions.

Towa Corporation: Stock Price Analysis And Long-Term Performance

Understanding the essential aspects of Towa Corporation's stock price analysis and long-term performance is crucial for informed investment decisions. Here are six key aspects to consider:

- Historical Performance: Towa Corporation's stock price has shown consistent growth over the past decade, providing investors with potential returns.

- Dividend Yield: The company offers a stable dividend yield, making it attractive to income-oriented investors.

- Earnings Growth: Towa Corporation has consistently reported positive earnings growth, indicating its financial strength.

- Technical Indicators: Technical analysis suggests that the stock is currently in an uptrend, with potential for further price appreciation.

- Market Sentiment: Positive analyst ratings and strong investor confidence contribute to the bullish sentiment surrounding the stock.

- Economic Outlook: The company's performance is closely tied to the automotive industry, making economic factors an important consideration.

Pay for Long Term Performance... - The Human Well - Source thehumanwell.com

These aspects collectively provide a comprehensive view of Towa Corporation's stock performance and help investors make informed investment decisions. By considering historical trends, financial health, and market dynamics, investors can assess the potential risks and rewards associated with investing in the company.

Towa Corporation: Stock Price Analysis And Long-Term Performance

The stock price performance of Towa Corporation is inextricably linked to its long-term financial performance. A comprehensive analysis of the company's stock price movements over time, coupled with an examination of its financial statements and industry trends, can provide investors with valuable insights into the company's overall health and future prospects.

Microsoft Corporation (MSFT) Stock Price Analysis and Forecast 2022 - Source contentclap.com

Factors such as revenue growth, profitability margins, and debt levels can significantly impact a company's stock price. For instance, a company with consistently increasing revenue and profit margins may witness a positive correlation in its stock price performance. Conversely, a company facing financial distress, declining sales, or mounting debt may experience a negative impact on its stock price.

Understanding the relationship between stock price and long-term performance allows investors to make informed decisions. By assessing a company's financial health and considering market conditions, investors can better gauge the potential risks and rewards associated with investing in a particular stock. This knowledge empowers them to develop tailored investment strategies that align with their financial goals and risk tolerance.

Conclusion

The analysis of Towa Corporation's stock price and long-term performance reveals the importance of considering both historical trends and current financial indicators when making investment decisions. Understanding the underlying fundamentals that drive stock price movements can help investors make informed choices and potentially maximize returns over the long term.

In conclusion, a thorough understanding of the connection between stock price and long-term performance is essential for successful investing. It empowers investors to make strategic decisions based on data and analysis, potentially leading to better investment outcomes.