Variable-Rate Mortgage: Understanding The Ups And Downs? Variable-Rate Mortgage: Understanding The Ups And Downs is a type of home loan where the interest rate fluctuates with market conditions. It can be a good option for borrowers who expect interest rates to stay low or decline, but it can also be risky if rates rise significantly.

Editor's Notes: Variable-Rate Mortgage: Understanding The Ups And Downs published today date. This guide will help you to understand the pros and cons of variable-rate mortgages so that you can make an informed decision about whether or not one is right for you.

We've done the analysis, dug into the details, and put together this Variable-Rate Mortgage: Understanding The Ups And Downs guide to help you make the right decision.

Key differences or Key takeways

Here are some of the key differences between variable-rate mortgages and fixed-rate mortgages:

| Feature | Variable-Rate Mortgage | Fixed-Rate Mortgage |

|---|---|---|

| Interest rate | Fluctuates with market conditions | Fixed for the life of the loan |

| Monthly payments | Can change over time | Stay the same for the life of the loan |

| Risk | Higher risk if rates rise | Lower risk |

Transition to main article topics

In this guide, we will discuss the following topics:

- How variable-rate mortgages work

- The pros and cons of variable-rate mortgages

- How to decide if a variable-rate mortgage is right for you

FAQs

This section aims to provide answers to frequently asked questions regarding variable-rate mortgages, shedding light on their complexities and potential implications.

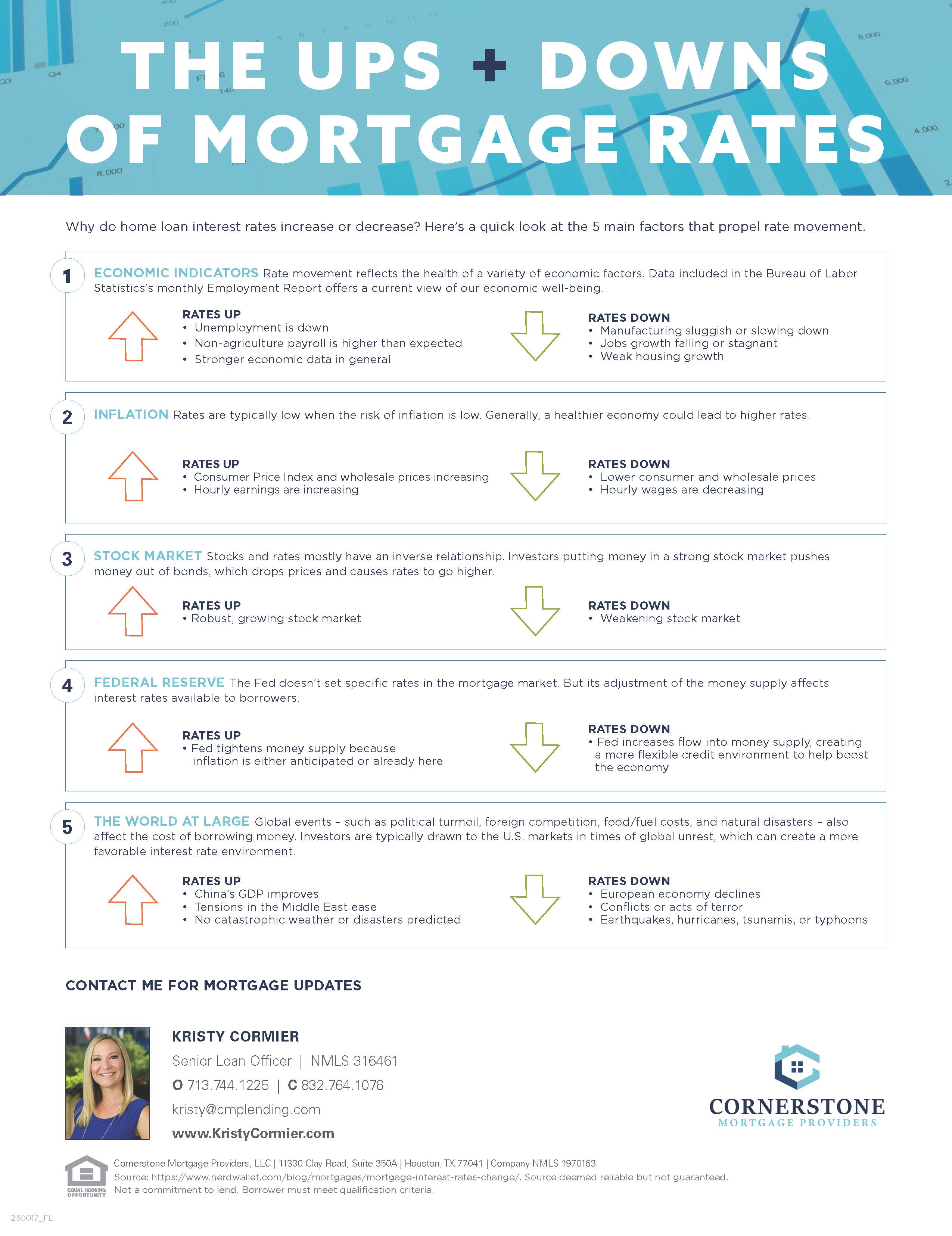

The Ups and Downs of Mortgage Rates - Source newmarkhomes.com

Question 1: How do variable-rate mortgages differ from fixed-rate mortgages?

Unlike fixed-rate mortgages, which maintain a constant interest rate throughout the loan term, variable-rate mortgages have interest rates that fluctuate based on market conditions. This means that the monthly payments can vary, potentially leading to both savings and increased expenses.

Question 2: What factors influence changes in variable-rate mortgage interest rates?

Changes in variable-rate mortgage interest rates are primarily driven by movements in the index to which they are tied, such as the prime rate or the London Interbank Offered Rate (LIBOR). Economic factors, such as inflation and central bank monetary policy, can also impact these indices and, consequently, the interest rates.

Question 3: What are the potential benefits of variable-rate mortgages?

In a declining interest rate environment, variable-rate mortgages can offer lower initial interest rates, resulting in lower monthly payments compared to fixed-rate mortgages. However, it is crucial to note that interest rates can also rise, which could lead to higher monthly payments in the future.

Question 4: What are the potential risks associated with variable-rate mortgages?

The primary risk associated with variable-rate mortgages is the potential for interest rate increases. Rising interest rates can result in higher monthly payments, potentially straining budgets and making it challenging to manage cash flow. It is essential to carefully consider this risk before opting for a variable-rate mortgage.

Question 5: How can individuals assess if a variable-rate mortgage is suitable for their circumstances?

Before choosing a variable-rate mortgage, individuals should thoroughly evaluate their financial situation and risk tolerance. They should consider their income stability, future financial commitments, and the potential impact of interest rate fluctuations on their budget. Consulting with a qualified financial advisor can provide valuable guidance in making an informed decision.

Question 6: What are some alternatives to variable-rate mortgages?

Individuals who are not comfortable with the potential interest rate fluctuations associated with variable-rate mortgages may consider fixed-rate mortgages or adjustable-rate mortgages with caps and floors. These alternatives offer varying degrees of stability and flexibility and should be carefully evaluated based on individual needs.

In summary, variable-rate mortgages can offer potential benefits but also carry certain risks. By thoroughly understanding the factors that influence interest rate fluctuations and carefully assessing their financial situation, individuals can make an informed decision on whether a variable-rate mortgage is the right choice for them.

Next Article Section: Additional Considerations for Understanding Variable-Rate Mortgages

Tips

A Variable-Rate Mortgage: Understanding The Ups And Downs (VRM) can be a complex financial instrument, but it's important to understand the potential risks and benefits before making a decision. Here are some tips to help you understand the ups and downs of a VRM:

Life Is A Series Of Ups & Downs · Cozy Little House - Source cozylittlehouse.com

Tip 1: Understand how a VRM works. A VRM is a type of mortgage where the interest rate is not fixed, but instead fluctuates with the market. This means that your monthly payments could increase or decrease over time.

Tip 2: Consider your financial situation. A VRM can be a good option if you have a stable income and can afford to make higher payments if interest rates rise. However, if you have a tight budget, a VRM may not be a good choice.

Tip 3: Shop around for the best rate. There are many different lenders that offer VRMs, so it's important to shop around for the best rate. Be sure to compare the interest rates, fees, and other terms of the loan.

Tip 4: Get professional advice. If you're not sure whether a VRM is right for you, it's a good idea to talk to a financial advisor. They can help you weigh the pros and cons of a VRM and make a decision that's right for you.

By following these tips, you can help yourself make an informed decision about whether a VRM is right for you.

Key takeaways:

- A variable-rate mortgage can be a good option if you have a stable income and can afford to make higher payments if interest rates rise.

- It's important to shop around for the best rate and get professional advice before making a decision about a VRM.

- By following these tips, you can help yourself make an informed decision about whether a VRM is right for you.

Conclusion:

Variable-rate mortgages can be a complex financial instrument, but by understanding the potential risks and benefits, you can make an informed decision about whether a VRM is right for you.

Variable-Rate Mortgage: Understanding The Ups And Downs

Variable-rate mortgages (VRMs) offer lower initial interest rates than fixed-rate mortgages, but come with the inherent risk of fluctuating interest rates. It's crucial to be aware of the complexities and potential implications of VRMs.

- Interest Rate Fluctuations: Interest rates on VRMs can change periodically, impacting monthly payments and long-term costs.

- Market Sensitivity: VRMs are highly influenced by economic conditions and can be susceptible to rapid rate changes.

- Payment Shock: Sudden or significant interest rate increases can lead to unexpected payment increases, potentially straining affordability.

- Refinancing Opportunities: If interest rates drop, refinancing a VRM can lock in lower rates and reduce monthly payments.

- Borrower Suitability: VRMs are suitable for borrowers with strong financial reserves and the ability to withstand potential payment fluctuations.

- Risk Management: Strategies like interest rate caps or buydowns can help mitigate the risk associated with VRMs.

Understanding these key aspects is vital for borrowers considering VRMs. It's essential to weigh the potential risks and benefits against personal financial circumstances and risk tolerance. Informed decision-making can help individuals navigate the ups and downs of VRMs successfully.

Contract Brewing Ups & Downs - Specific Mechanical Systems - Source specificmechanical.com

Ups & Downs Concrete Watch Harbour Edition - Gessato Design Store - Source shop.gessato.com

Variable-Rate Mortgage: Understanding The Ups And Downs

Variable-rate mortgages (VRMs) have interest rates subject to adjustment, based on market conditions. They often offer lower initial rates than fixed-rate mortgages (FRMs), but entailing potential risks and rewards. Fluctuations in interest rates can result in variations of monthly payments, potentially straining budgets if rates increase. Alternatively, they might decrease, leading to savings.

Picture3 | Pirates & Princesses - Source www.piratesandprincesses.net

Choosing between a VRM and an FRM hinges on personal circumstances, risk tolerance, and financial goals. Stability-seekers may opt for FRMs, ensuring consistent payments. Conversely, those comfortable with uncertainty and desiring lower initial rates may prefer VRMs. Regardless of the mortgage type, understanding the implications of interest rate changes is crucial.

VRMs offer adjustable rates, affected by financial indices like the Prime Rate or LIBOR. When these indices rise, VRM rates increase, and vice versa. As a result, mortgage payments fluctuate, impacting monthly housing expenses.

The connection between "Variable-Rate Mortgage: Understanding the Ups and Downs" revolves around the effects of interest rate changes on monthly payments, emphasizing the importance of comprehending the risks and benefits associated with VRMs. By staying informed, homeowners can make well-rounded financial decisions, ensuring alignment with their individual needs and risk tolerance.

Conclusion

Variable-rate mortgages offer a distinct combination of potential risks and rewards, tied to the fluctuations of market interest rates. Understanding the implications of these adjustments is essential for informed decision-making.

Homeowners opting for VRMs should brace themselves for potential variations in monthly payments, based on prevailing economic conditions affecting interest rates. While the initial rates may be enticing, it is crucial to consider the long-term implications and align with personal risk tolerance levels.