Bank Of Japan Monetary Policy Meeting: Latest Interest Rate Decisions And Economic Outlook

Editor's Notes: The Bank of Japan's (BOJ) held its latest monetary policy meeting on July 20-21, 2023. At the meeting, the BOJ decided to maintain its ultra-loose monetary policy stance, keeping interest rates at record lows. The decision was widely expected by markets.

The BOJ's decision to maintain its current policy stance was based on its assessment that the Japanese economy is still facing significant challenges. The economy has been slow to recover from the COVID-19 pandemic, and inflation remains below the BOJ's target of 2%. The BOJ also noted that the global economic outlook is uncertain, with the war in Ukraine and the rising cost of living weighing on growth.

The BOJ's decision to maintain its ultra-loose monetary policy stance is likely to continue to be controversial. Some economists argue that the BOJ is keeping interest rates too low for too long, which could lead to asset bubbles and financial instability. Others argue that the BOJ is right to maintain its current policy stance, given the still-weak state of the Japanese economy.

The BOJ's next monetary policy meeting is scheduled for September 20-21, 2023. At that meeting, the BOJ is expected to provide an update on its assessment of the Japanese economy and its monetary policy stance.

FAQs

Here are some frequently asked questions about the Bank of Japan's Monetary Policy meeting and interest rate decisions:

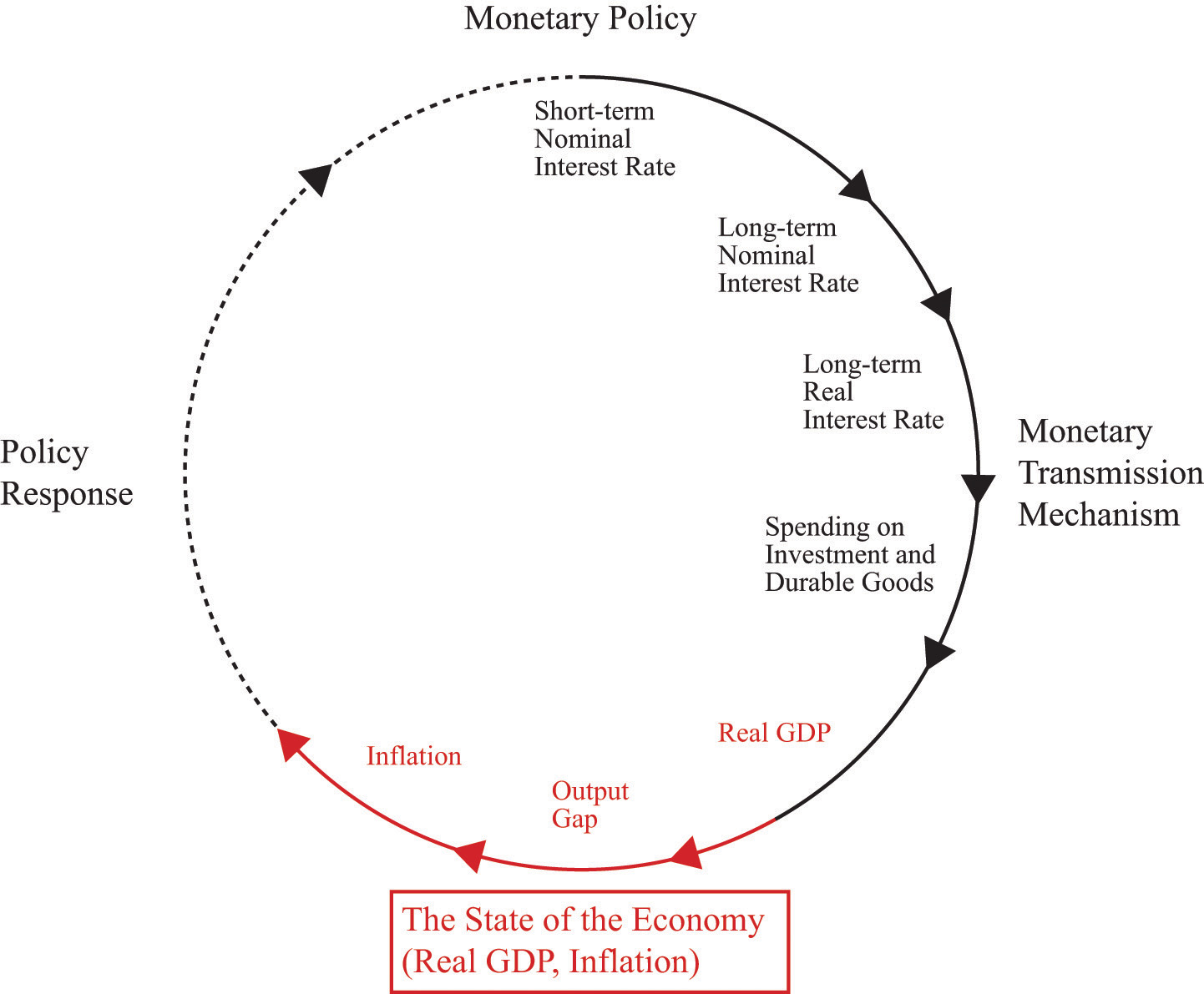

Monetary Policy, Prices, and Inflation - Source saylordotorg.github.io

Question 1: What was the outcome of the latest Bank of Japan Monetary Policy meeting?

Answer: At the latest meeting, the Bank of Japan decided to maintain its ultra-loose monetary policy, keeping interest rates at ultra-low levels.

Question 2: Why did the Bank of Japan decide to maintain its ultra-loose monetary policy?

Answer: The Bank of Japan maintained its ultra-loose monetary policy to support economic growth and achieve its inflation target of 2%.

Question 3: What is the Bank of Japan's inflation target?

Answer: The Bank of Japan's inflation target is 2%.

Question 4: What are the economic implications of the Bank of Japan's monetary policy?

Answer: The Bank of Japan's ultra-loose monetary policy has helped to stimulate economic growth, but it has also led to some concerns about financial stability.

Question 5: What is the outlook for the Japanese economy?

Answer: The outlook for the Japanese economy is uncertain, with some economists predicting continued growth and others forecasting a slowdown.

Question 6: What are the challenges facing the Bank of Japan?

Answer: The Bank of Japan faces a number of challenges, including achieving its inflation target, managing financial stability, and coping with an aging population.

For more information about the Bank of Japan's Monetary Policy meeting and interest rate decisions, please visit the Bank of Japan's website.

Tips

Learn about the latest interest rate decisions and economic outlook from the Bank of Japan Monetary Policy Meeting. Bank Of Japan Monetary Policy Meeting: Latest Interest Rate Decisions And Economic Outlook

Fed Interest Rate Projections 2025 - Mary W. Quiroz - Source marywquiroz.pages.dev

Tip 1: Stay updated on monetary policy decisions

The Bank of Japan's Monetary Policy Meeting determines interest rates, which can have a significant impact on the economy. By staying informed about these decisions, individuals and businesses can make informed financial decisions.

Tip 2: Monitor economic indicators

The Bank of Japan's economic outlook provides insights into the health of the Japanese economy. By tracking indicators such as GDP growth, inflation, and unemployment, individuals and businesses can assess the overall economic environment.

Tip 3: Consider the impact on your finances

Interest rate decisions and economic conditions can influence personal finances. Individuals and businesses should consider how these factors may affect their savings, investments, and financial planning.

Tip 4: Seek professional advice

If you need more in-depth analysis or personalized guidance, consider consulting with a financial advisor or economist. They can provide tailored advice based on your specific circumstances and financial goals.

Tip 5: Stay informed through multiple sources

To gain a comprehensive understanding, refer to reputable sources such as official Bank of Japan publications, financial news outlets, and economic research institutions.

By following these tips, you can stay informed and make informed decisions regarding your finances and the economy.

Bank Of Japan Monetary Policy Meeting: Latest Interest Rate Decisions And Economic Outlook

The Bank of Japan's (BOJ) monetary policy meeting holds great significance for Japan's financial landscape and the global economic outlook. Key aspects to consider during this event include interest rate decisions, economic growth projections, inflation assessments, market reactions, and global economic implications.

- Interest Rate Decisions: The BOJ's decision to maintain, alter, or adjust interest rates directly influences the cost of borrowing and economic activity.

- Economic Growth Projections: The BOJ's forecasts on Japan's economic growth indicate the pace and strength of economic expansion, providing insights into future business conditions.

- Inflation Assessments: The BOJ's analysis of inflation trends, including the core consumer price index, sheds light on price stability and the effectiveness of monetary policy measures.

- Market Reactions: The market's response to the policy meeting, including stock price movements and currency fluctuations, reflect investor confidence and expectations.

- Global Economic Implications: The BOJ's policy decisions have implications for global financial markets and currencies, influencing investment flows and economic sentiment worldwide.

- Monetary Policy Framework: The BOJ's ongoing review and assessment of its monetary policy framework, including quantitative easing and yield curve control, will be closely monitored.

These aspects provide a comprehensive understanding of the BOJ's monetary policy meeting. The BOJ's decisions and economic outlook have a direct impact on Japan's financial system and economic trajectory, while also contributing to global economic stability and growth.

Japan economic outlook | Deloitte Insights - Source www2.deloitte.com

Bank Of Japan Monetary Policy Meeting: Latest Interest Rate Decisions And Economic Outlook

The Bank of Japan (BOJ) recently concluded its monetary policy meeting, where it decided to maintain its ultra-low interest rates. This move was widely expected by economists, as the BOJ continues to grapple with persistently low inflation and a sluggish economy. The decision to keep rates unchanged underscores the challenges faced by central banks in stimulating growth in an era of low interest rates.

Japan central bank acts to stem yen's decline against dollar | AP News - Source apnews.com

The BOJ's decision is a reflection of the challenges facing the Japanese economy. Despite years of quantitative easing and other stimulus measures, inflation remains stubbornly below the BOJ's target of 2%. The economy has also been sluggish, with growth averaging just 1% over the past decade. The BOJ's decision to maintain low interest rates is an attempt to boost growth and inflation, but it remains to be seen whether it will be successful.

The BOJ's decision has implications for the global economy. Low interest rates in Japan can put downward pressure on interest rates in other countries, as investors seek higher returns. This can lead to a global "race to the bottom" on interest rates, which can make it difficult for central banks to stimulate growth. The BOJ's decision is a reminder of the challenges facing central banks in the current economic environment.

Conclusion

The Bank of Japan's decision to maintain low interest rates highlights the challenges facing central banks in stimulating growth in an era of low inflation. The BOJ's decision is a reflection of the ongoing weakness of the Japanese economy, and it has implications for the global economy as well.

It remains to be seen whether the BOJ's decision will be successful in boosting growth and inflation in Japan. However, it is clear that the BOJ is facing an uphill battle, and that the challenges facing the Japanese economy are not likely to be resolved quickly.