Are you looking to understand the intricate world of Social Insurance? Look no further than "Social Insurance: A Comprehensive Guide To Coverage, Benefits, And Contributions."

Editor's Note: "Social Insurance: A Comprehensive Guide To Coverage, Benefits, And Contributions" has been published today, giving the importance and benefits of social insurance.

Our team of experts has meticulously analyzed and compiled this guide, catering to your need to navigate the complexities of social insurance. We have delved into the depths of coverage, benefits, and contributions, empowering you to make well-informed decisions.

| Key Difference | Social Security | Social Insurance |

|---|---|---|

| Employer Contribution | Yes | May vary |

| Funding Source | Payroll taxes | Combination of sources |

| Benefits | Retirement, disability, survivors | Broader range, including healthcare, unemployment, workers' compensation |

Let's dive deeper into the essential concepts of social insurance:

![]()

Insurance Coverage Icon Style 9485484 Vector Art at Vecteezy - Source www.vecteezy.com

FAQ

This comprehensive guide aims to answer frequently asked questions about social insurance, covering topics such as coverage, benefits, and contributions. By addressing common concerns, we hope to provide clarity and empower individuals with the knowledge they need to make informed decisions regarding their social insurance protection.

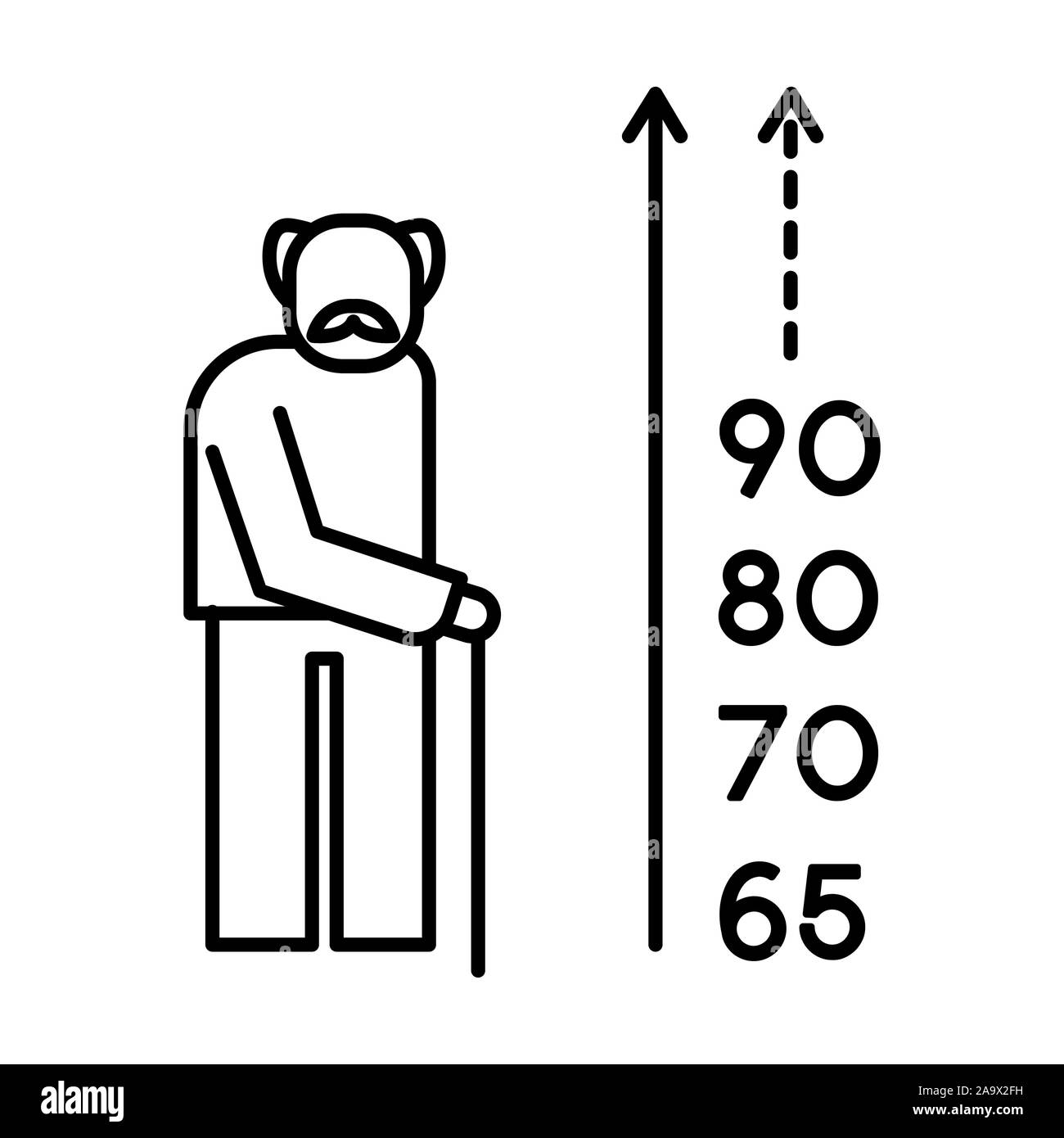

Social insurance fund Black and White Stock Photos & Images - Alamy - Source www.alamy.com

Question 1: What is the purpose of social insurance?

Social insurance serves as a collective safety net, ensuring that individuals and their families have access to essential benefits during times of need or financial hardship. It offers peace of mind and financial protection for events such as retirement, unemployment, workplace accidents, or long-term illness.

Question 2: Who is eligible for social insurance benefits?

Eligibility criteria for social insurance benefits vary depending on the specific program and country. However, eligibility typically depends on factors such as citizenship, residence, and employment status. Individuals may need to meet certain contribution requirements or income thresholds to qualify for benefits.

Question 3: What are the different types of social insurance programs?

There are various types of social insurance programs, including:

- Retirement pension plans, which provide income replacement for individuals who have reached retirement age.

- Unemployment insurance programs, which provide temporary financial assistance to those who have lost their jobs through no fault of their own.

- Workers' compensation programs, which offer medical and income benefits to employees who suffer work-related injuries or illnesses.

- Disability insurance programs, which provide income support to individuals who are unable to work due to a disability.

- Health insurance programs, which provide coverage for medical expenses and healthcare services.

Question 4: How are social insurance programs funded?

Social insurance programs are typically funded through a combination of employer and employee contributions, as well as government subsidies in some cases. Contributions are usually based on a percentage of wages or income, and they are collected through payroll deductions.

Question 5: What are the potential benefits of social insurance?

Social insurance provides numerous potential benefits, including:

- Financial security and peace of mind during periods of income loss or financial hardship.

- Access to essential healthcare services and medical treatment.

- Protection against the financial burden of work-related injuries or illnesses.

- Support for individuals during retirement and old age.

- Reduced economic inequality and social disparities.

Question 6: What are some common misconceptions about social insurance?

One common misconception is that social insurance is a form of government welfare. In reality, social insurance programs are typically funded through contributions from employers and employees, rather than solely relying on tax revenue.

In summary, social insurance plays a crucial role in providing financial protection and ensuring the well-being of individuals and their families. Understanding the purpose, eligibility criteria, benefits, funding mechanisms, and common misconceptions surrounding social insurance can empower individuals to make informed decisions and safeguard their future.

To delve deeper into social insurance, explore the following sections for detailed information on coverage, benefits, contributions, and the latest developments in social insurance programs.

Tips

Understanding Social Insurance: A Comprehensive Guide To Coverage, Benefits, And Contributions is crucial for navigating the complexities of social protection systems. Here are some valuable tips to help you make the most of your social insurance coverage.

Tip 1: Know Your Coverage Options

Determine the specific benefits and services available under your social insurance plan. These may include retirement pensions, disability benefits, health insurance, and unemployment insurance. Familiarize yourself with the eligibility criteria, contribution requirements, and benefit amounts.

Tip 2: Calculate Your Contributions

Understanding how much you contribute to social insurance is essential for financial planning. The amount you contribute may vary based on your income, employment status, and the specific social insurance program. Use online calculators or consult with a financial advisor to estimate your contributions and plan accordingly.

Tip 3: Maximize Your Benefits

Make the most of the benefits available to you under social insurance. If you face unemployment, disability, or retirement, ensure you meet the eligibility requirements and file your claims promptly. Exploring additional benefits, such as survivor pensions or family allowances, can provide financial support during life events.

Tip 4: Plan for the Long Term

Social insurance provides long-term security and peace of mind. Consider contributing to retirement savings plans or private insurance to supplement your social insurance benefits. Early planning will help you maintain financial stability and achieve your financial goals.

Tip 5: Stay Informed

Stay updated on changes to social insurance laws and regulations. Regularly review your coverage and contributions to ensure they align with your life circumstances and financial needs. Consult government websites, financial advisors, or legal professionals for guidance and clarification.

By following these tips, you can make informed decisions about your social insurance coverage, optimize your benefits, and secure a financially stable future for yourself and your loved ones.

Social Insurance: A Comprehensive Guide To Coverage, Benefits, And Contributions

Social insurance programs, such as Social Security and Medicare, provide crucial support to individuals and families, ensuring financial protection during life's uncertainties. Understanding the essential aspects of coverage, benefits, and contributions is essential for maximizing the benefits of these programs.

- Coverage: Eligibility criteria, including age, income, and work history.

- Benefits: Types of benefits provided, such as retirement, disability, and survivor benefits.

- Contributions: Funding sources, including payroll taxes and general revenue.

- Sustainability: Financial health of programs and potential reforms to ensure long-term viability.

- Distribution: Equitable distribution of benefits among different population groups.

- Administration: Governance and management of programs to ensure efficiency and effectiveness.

Health Insurance Reform concept. Overhauling policies for comprehensive - Source www.alamy.com

These key aspects are interconnected and crucial for understanding the complexities of social insurance programs. Coverage determines who qualifies for benefits, while benefits provide the necessary financial support during challenging times. Contributions fund the programs and ensure their sustainability, while distribution ensures equitable access to benefits. Administration plays a vital role in efficient and effective program implementation. Understanding these aspects empowers individuals to make informed decisions about their financial future and appreciate the value of social insurance programs in safeguarding the well-being of society.

Comprehensive Insurance - Source fity.club

Social Insurance: A Comprehensive Guide To Coverage, Benefits, And Contributions

Social insurance plays a crucial role in providing financial security and protection to individuals and families in the event of various life events such as retirement, disability, unemployment, and medical expenses. It ensures that individuals have access to essential services and income support when they are unable to work or earn a living due to unforeseen circumstances.

Announcement regarding Cyprus Social Insurance Contributions - Fairfax - Source www.fairfaxyeaman.com

Understanding the components of social insurance, including coverage, benefits, and contributions, is essential for individuals to make informed decisions about their financial planning and future well-being. This comprehensive guide provides valuable insights into the intricacies of social insurance systems, enabling individuals to navigate the complexities of accessing benefits and fulfilling their contribution obligations.

In conclusion, social insurance serves as a vital safety net, protecting individuals from financial hardship and ensuring their access to essential services. By fostering a deeper understanding of social insurance, individuals can effectively plan for their future and contribute to the overall well-being of society.