SoftBank Group: Stock Price Analysis And Forecast For Investors

Editor's Notes:SoftBank Group: Stock Price Analysis And Forecast For Investors have published today. We did some analysis, digging information, made SoftBank Group: Stock Price Analysis And Forecast For Investors we put together this SoftBank Group: Stock Price Analysis And Forecast For Investors guide to help target audience make the right decision.

WeWork Co-Founder Sues SoftBank Over Canceled Stock Deal - Source www.costar.com

Key differences or Key takeways

Transition to main article topics

FAQs on SoftBank Group: Stock Price Analysis and Forecast for Investors

This FAQ section provides answers to common questions regarding SoftBank Group's stock price analysis and forecasts. It aims to assist investors in making informed decisions by clarifying key aspects and addressing potential concerns.

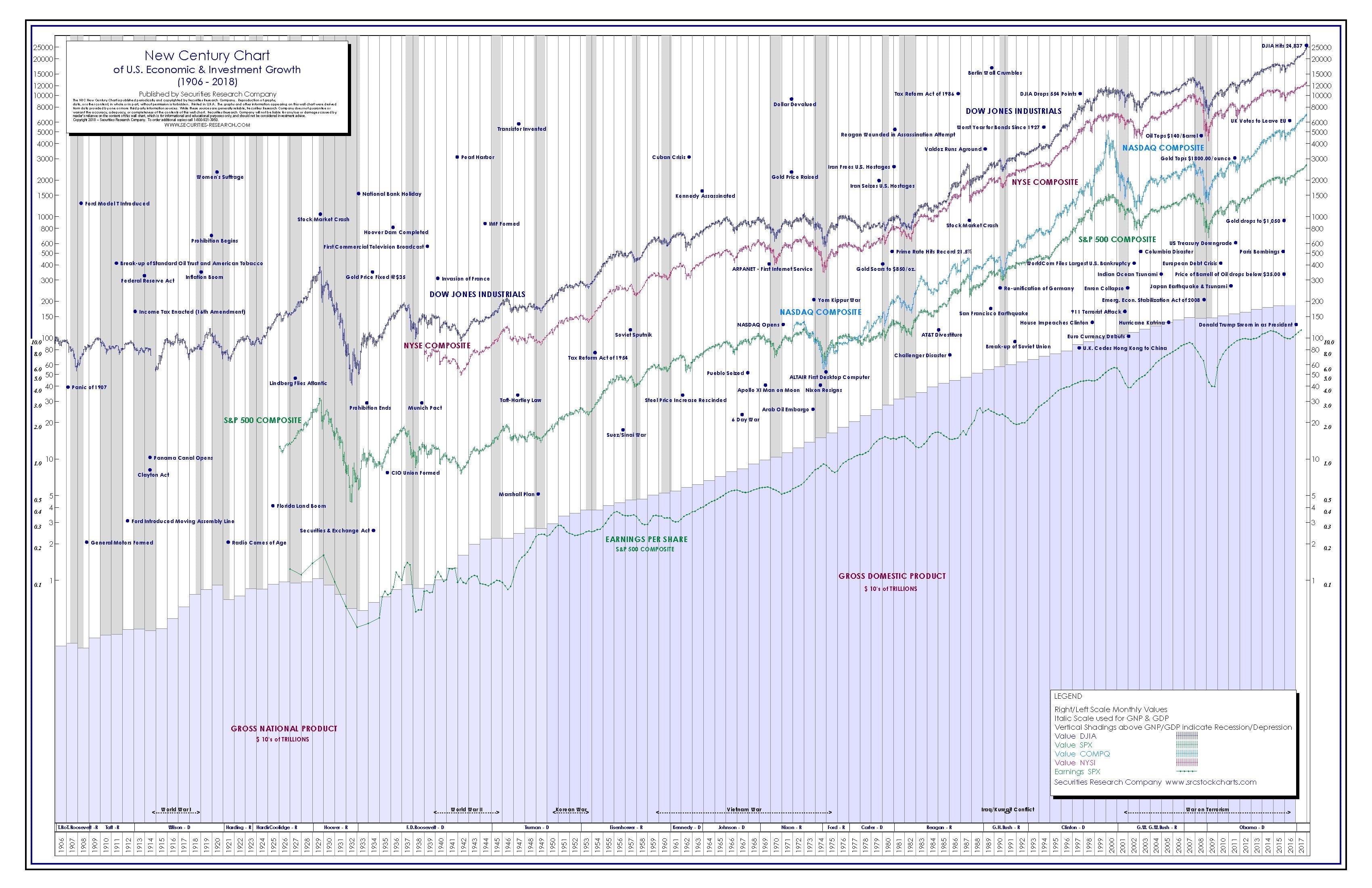

Understanding Dow Jones Stock Market Historical Charts and How it - Source www.securities-research.com

Question 1: What factors influence SoftBank Group's stock price?

SoftBank Group's stock price is influenced by a combination of factors, including its portfolio company performance, overall market conditions, macroeconomic factors, and investor sentiment. The performance of its key investments, such as Alibaba and Uber, significantly impacts its overall profitability. Additionally, broader economic trends and industry-specific news can affect the company's valuation.

Question 2: How do analysts forecast SoftBank Group's stock price?

Analysts use various methods to forecast SoftBank Group's stock price. These methods include fundamental analysis, which involves evaluating the company's financial performance and growth prospects, as well as technical analysis, which focuses on historical price patterns and trends. Analysts also consider market sentiment and industry trends when making their forecasts.

Question 3: What are the risks associated with investing in SoftBank Group's stock?

As with any investment, investing in SoftBank Group's stock carries risks. These risks include the volatility of the stock market, the performance of the company's portfolio companies, and changes in the regulatory landscape. Additionally, investors should be aware of the potential impact of macroeconomic factors on the company's operations.

Question 4: What is the consensus outlook for SoftBank Group's stock?

The consensus outlook for SoftBank Group's stock is generally positive, with many analysts predicting continued growth in the long term. However, it is important to note that stock market forecasts are not always accurate, and investors should conduct their research before making any investment decisions.

Question 5: What are the potential rewards of investing in SoftBank Group's stock?

Potential rewards of investing in SoftBank Group's stock include capital appreciation as the company grows and expands its portfolio. Additionally, investors may benefit from dividends paid by the company. However, it is essential to remember that all investments carry risks, and investors should carefully consider their risk tolerance before investing.

Question 6: How can investors stay informed about SoftBank Group's stock performance and news?

Investors can stay informed about SoftBank Group's stock performance and news by monitoring financial news outlets, following the company on social media, and visiting the company's official website for updates. Additionally, investors can subscribe to email alerts or use online tools to track the stock's price movements and receive news updates.

In conclusion, understanding the factors that influence SoftBank Group's stock price, the methods used to forecast its future performance, and the potential risks and rewards involved is crucial for informed investment decisions. By staying informed and carefully considering their risk tolerance, investors can navigate the stock market and potentially benefit from the company's growth.

Moving on to the next section of the article...

Tips for Analyzing and Forecasting SoftBank Group's Stock Price

For investors considering an investment in SoftBank Group, conducting thorough stock price analysis and forecasting is crucial. Here are some helpful tips to guide you through the process:

Tip 1: Understand SoftBank Group's Business Model

Gaining a comprehensive understanding of SoftBank Group's core businesses, investment strategies, and global operations is essential. This knowledge will provide a solid foundation for analyzing the company's financial performance, growth potential, and risks.

Tip 2: Evaluate Financial Health

Carefully review SoftBank Group's financial statements to assess its financial health. Analyze key metrics such as revenue growth, profitability, debt levels, and cash flow to determine the company's financial strength and stability.

Tip 3: Monitor Industry Trends

Stay abreast of industry trends and developments that could impact SoftBank Group. Consider factors such as technological advancements, regulatory changes, and competitive dynamics to gauge the company's potential for long-term growth and profitability.

Tip 4: Analyze Technical Indicators

Incorporate technical analysis into your forecasting process to identify potential trading opportunities and price trends. By studying historical stock price data, volume, and momentum indicators, you can gain insights into market sentiment and potential price movements.

Tip 5: Consider Analyst Research

Leverage the expertise of financial analysts by reviewing their research reports on SoftBank Group. These reports provide valuable insights into the company's fundamentals, market outlook, and potential investment strategies.

Tip 6: Stay Informed of News and Events

Monitor news and events related to SoftBank Group to stay informed of any developments that could affect its stock price. Major announcements, earnings reports, and regulatory updates can significantly impact investor sentiment and market valuations.

Conducting thorough stock price analysis and forecasting for SoftBank Group requires a multifaceted approach. By following these tips, investors can gain a deeper understanding of the company's business, financial health, and market dynamics, empowering them to make informed investment decisions. For further insights, refer to SoftBank Group: Stock Price Analysis And Forecast For Investors.

SoftBank Group: Stock Price Analysis And Forecast For Investors

SoftBank Group, a leading technology conglomerate, has witnessed significant fluctuations in its stock price. Understanding key aspects of its stock performance is critical for investors seeking to make informed decisions.

- Historical Performance: Analyzing past price trends and volatility patterns.

- Industry Dynamics: Assessing the impact of technological advancements and regulatory changes on the telecommunications and investment sectors.

- Financial Position: Evaluating the company's financial health, including revenue growth, profitability, and debt levels.

- Valuation Metrics: Using financial ratios (e.g., P/E ratio, P/S ratio) to determine the company's intrinsic value relative to the market.

- Analyst Forecasts: Reviewing estimates from research analysts regarding future stock price movements and potential catalysts.

- Technical Analysis: Identifying chart patterns, support and resistance levels, and other indicators that may provide insights into future price direction.

In-depth analysis of these key aspects provides investors with a comprehensive understanding of SoftBank Group's stock performance. By considering historical trends, industry factors, financial strength, valuation metrics, and expert forecasts, investors can make informed investment decisions and potentially mitigate risks associated with stock market volatility.

SoftBank Group Logo-01 - Congressional Baseball Game - Source www.congressionalbaseball.org

SoftBank Group: Stock Price Analysis And Forecast For Investors

SoftBank Group Corp. is a Japanese multinational telecommunications and internet corporation. It is the world's largest telecommunications company, serving approximately 3.5 billion people, and the world's third-largest mobile operator. The company's diversified portfolio includes telecommunications, internet, AI, robotics, and financial services.

STOCK PRICE ANALYSIS Furkan Ali TASCI --.pptx - Source www.slideshare.net

SoftBank's stock price has been on a roller coaster ride in recent years. The stock reached an all-time high in March 2021, but then it plummeted by more than 50%. The stock has since recovered some of its losses, but it is still trading below its all-time high.

There are a number of factors that have contributed to SoftBank's volatile stock price. These include the company's exposure to the Chinese market, its investments in risky startups, and its high levels of debt.

Despite the challenges, SoftBank remains a well-positioned company with a number of long-term growth drivers. The company's telecommunications business is a cash cow that generates a reliable stream of revenue. SoftBank's investments in AI and robotics could also pay off in the long term.

Investors who are considering investing in SoftBank should be aware of the risks involved. The company's stock price is likely to continue to be volatile. However, for investors with a long-term investment horizon, SoftBank could be a rewarding investment.

| Factor | Impact on Stock Price |

|---|---|

| Exposure to the Chinese market | The Chinese market is SoftBank's largest market. A slowdown in the Chinese economy could hurt SoftBank's revenue and profits. |

| Investments in risky startups | SoftBank has invested billions of dollars in risky startups. These investments could pay off, but they could also lead to losses. |

| High levels of debt | SoftBank has a high level of debt. If the company's debt becomes too high, it could lead to a downgrade in its credit rating and an increase in its interest expenses. |